Time is money! So saving time on your landlord tax return can be a good way to save money …. as well as a lot of hard work and effort too. In this post we will look at how to save time on your landlord tax return and at the ways the PaTMa landlord tax return feature can help you be more efficient.

Do it in advance

Although you can wait until your landlord tax return is almost due if you want to, collecting the information you need well in advance is much more efficient.

Here’s more information on the deadlines you need to meet when filing your landlord tax return.

With the PaTMa landlord tax return feature you don’t need to wait until the start of the tax year or the start of a tenancy. You can begin using it at any time of the year, and add new properties and new tenancies (and remove them) whenever you like.

Do it regularly

You can either collect the information you need for your landlord tax return on an ‘as you go’ basis monthly or weekly, or you can wait until the end of the tax year and do it all in one go.

Both approaches are acceptable, although a little-but-often approach is more manageable and avoids a last minute rush.

The PaTMa landlord tax return feature works with either approach. Here’s more information on how it works.

PaTMa can even help with reminders for regular record keeping.

Do your landlord tax return yourself

While some landlords opt to use a bookkeeper or accountant to complete their landlord tax return a DIY approach can save the time involved with telephone calls, meetings, receiving and answering emails and letters.

The PaTMa landlord tax return feature has been specially developed to be simple and user-friendly. Anyone, even those without bookkeeping or accountancy expertise, can use it to compile the figures needed for their landlord tax return.

As well as saving time PaTMa can also help save on accountancy bills.

Do it online

Filing your landlord tax return online rather than on paper is one of the simplest ways to save time. HMRC’s online system uses a step by step approach and will do a lot of the calculations for you.

Here’s more information on how to complete your landlord tax return online.

Use the right software for the job

While you can use generalised accounting software, a system of multiple spreadsheets or even paper records, a specialist landlord accounting system is much more efficient.

The PaTMa landlord tax return feature has been designed specifically to collect all the information needed for a landlord tax return. It’s much simpler and quicker than poring over spreadsheets or paper forms.

Go paperless

While a paper based filing system is still perfectly acceptable you can save time by scanning or photographing receipts, invoices and other documents as you receive them and storing them electronically for safekeeping.

The PaTMa landlord tax return feature allows you to upload documents alongside the records for every property in your portfolio. It avoids the need to file and store paper documents, searching for them when you need them, and the risk of losing them.

Follow good record keeping practices

Making sure you keep careful and accurate records is an often-overlooked but very effective way of saving time on your landlord tax return. Getting it right first time avoids the need to go back and correct errors, or worse still, filing a landlord tax return that contains mistakes.

Sometimes this is easier said than done, but there are many ways the PaTMa landlord tax return feature can help here:

-

It takes a systematic, step by step approach that is easy to follow.

-

It offers time saving hints and tips along the way.

-

It means you only need to enter each piece of information once, not over and over again.

-

It ensures that all your landlord income and property expenses can be properly categorised and recorded. For example, rent payments, allowable expenses, capital expenditure, mortgage interest and capital repayments can all be correctly recorded.

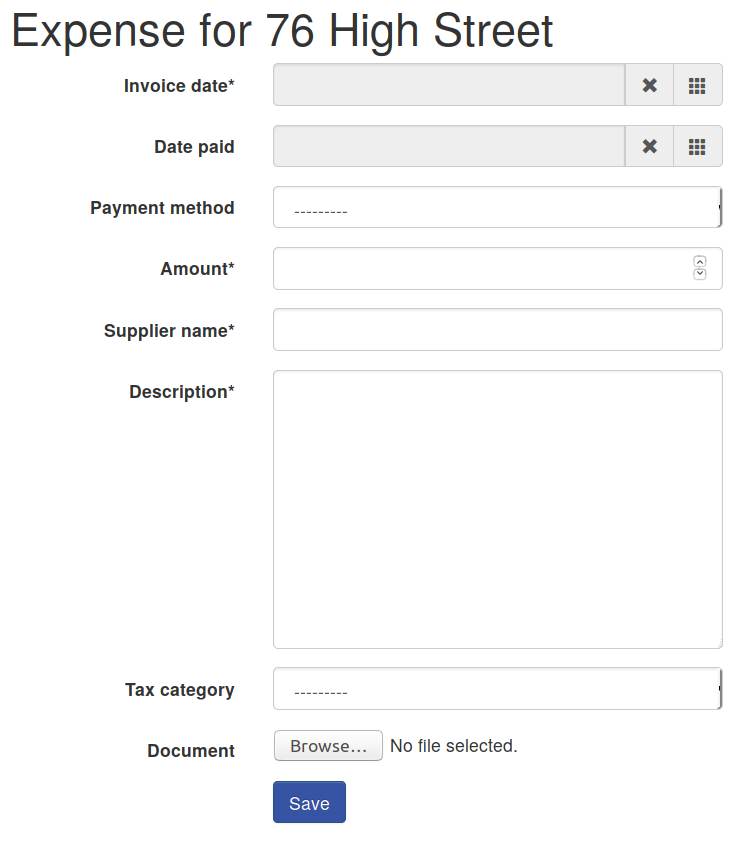

Here you can see how easily PaTMa allows you to add an expense, allocate it to the right tax category and upload the related document:

-

It completes all the necessary calculations for you automatically, saving time and avoiding the mistakes that can happen with manual calculations.

-

It presents the final figures you need instantly and in an easy-to-understand way. All you need to do is check them and then simply add them into your landlord tax return.

More benefits of good record keeping and the PaTMa landlord tax return feature:

Good record keeping can offer many other benefits, not just time saving. It means you can avoid any possible penalties for filing your landlord tax return late. And it reduces the risk of any fines or penalties for making mistakes in your return.

Accurate record keeping can provide useful and valuable financial information and portfolio insights. It can help you budget properly, keep tabs on maintenance costs and overheads and monitor rent arrears.

So, while the PaTMa landlord tax return feature is saving you time on completing your landlord tax return it is also boosting your efficiency and making your letting business more successful and profitable too.

Here’s more information about how PaTMa works: It shows how you can quickly and easily add properties and new tenancies, record rental payments, record your expenses and mortgage interest and then automatically generate the figures to complete your landlord tax return.

This video shows how PaTMa uses the data you record while managing your properties to provide figures for your landlord self assessment tax return page with just a click:

Useful information

Keeping up to date with the latest tax rules and regulations is also a good way of saving time on your landlord tax return. You can find all the HMRC Self Assessment forms and helpsheets for UK property here.