You can use PaTMa to simply track all your landlord finances and it comes complete with a tax return report to help with your self assessment.

This article is part of a series guiding you from an empty account, through entering all the data required, to PaTMa calculating your landlord tax return figures.

You can find the other parts here:

Part 1 - Creating your properties

Part 2 - Adding tenancies and adjusting to ignore the past

Part 3 - Recording rent payments

Part 4 - Recording mortgage interest (this post)

Part 5 - Recording other expenses

Part 6 - Generate and check your tax figures

What you'll get

After this part of the guide you'll have all your mortgage interest payments recorded and your PaTMa graphs will really be getting useful.

What you need

- Mortgage (or if necessary, bank) statements showing the mortgage payments you made.

- If you have any repayment mortgages you'll also need to know how the payments are split between interest and capital repayments.

If you've got a property portfolio without any mortgages, you can skip ahead to part 5 to start recording other expenses.

What to do

Working from your mortgage statements is probably going to be easiest for this process as they will likely be per-property and will show your interest.

So on that basis, choose you first mortgaged property and follow these simple steps to get started.

- From the property list...

- Click the appropriate property image

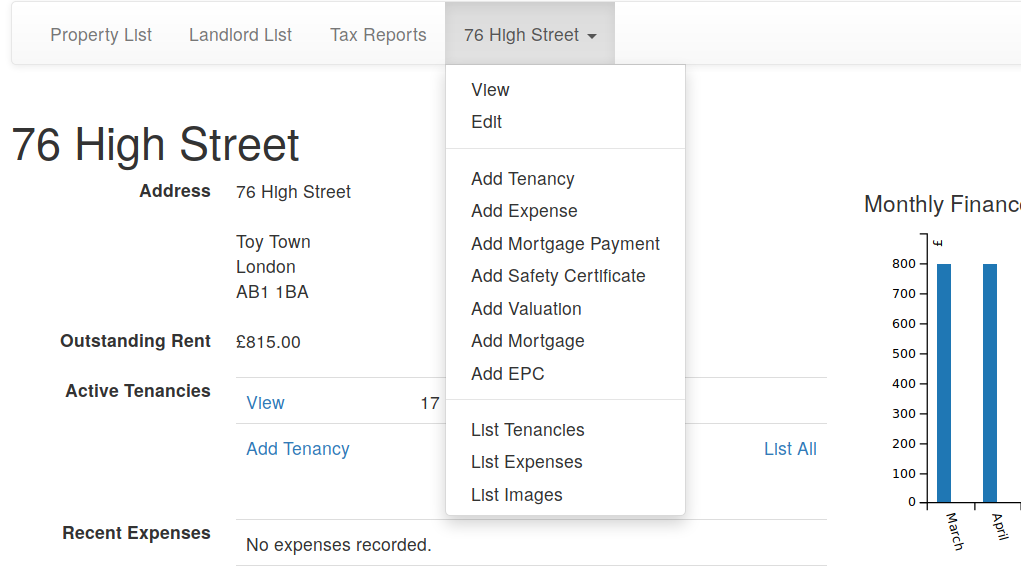

- Open the property menu

- Click the "Add mortgage payment" menu item

Here's what the menu will look like:

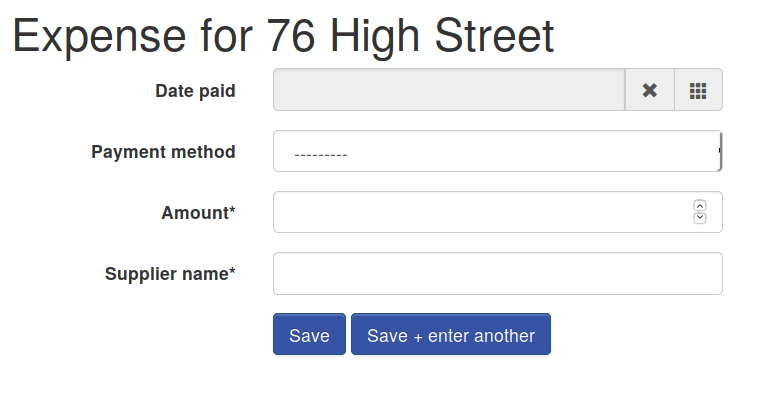

You'll then be presented with the mortgage payment form (which is a cut-down version of the expense form). Here's what it should look like:

This form must be used only for mortgage interest, you can add any repayment mortgage expenses in the next part of this guide.

With that in mind, select the appropriate date for the first payment on your mortgage statement, choose the payment method (most likely "bank transfer" which covers standing orders and direct debits), enter the amount and the name of the mortgage provider.

While you've got more payments on the same statement, click "Save + enter another" to get a head start on the next entry. Make sure you remember to set the next date and update anything else that's different on the next payment.

On the last one for the property click "Save" to return to the property view. Don't worry if you forget and click to enter another, you can use the menu at the top to navigate back to the property view at any time.

Once that property is complete, click "Property List" at the top of the page to view your list and choose the next mortgaged property. Just repeat the same process to enter the mortgage interest.

Bonus

While you've got your mortgage statements in front of you, why not store a few extra details about them. PaTMa can then use these details to improve the statistics and other information presented about your portfolio.

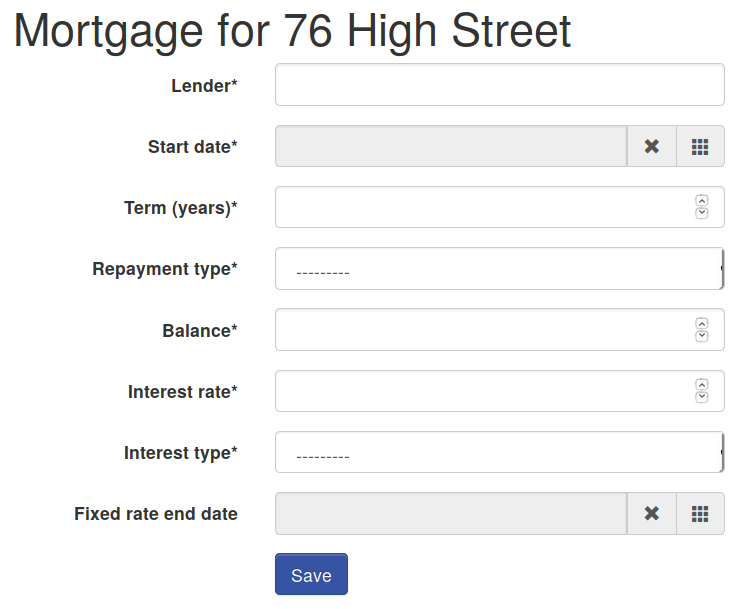

Click into the appropriate property detail page and scroll down almost to the bottom. There's a section labelled "Mortgages" - just click "Add Mortgage" to see a form like this:

Just fill in the details and click Save.

From the property detail page, scroll down again and this time click to "Add Valuation" - it's just above the mortgages section. Fill in that form as well and you'll enable insights on the value (and equity) of your portfolio.

What next

With mortgage expenses done, entering your other expenses in the next part will be super quick.