You can use PaTMa to simply track all your landlord finances and it comes complete with a tax return report to help with your self assessment.

This article is part of a series guiding you from an empty account, through entering all the data required, to PaTMa calculating your landlord tax return figures.

You can find the other parts here:

Part 1 - Creating your properties

Part 2 - Adding tenancies and adjusting to ignore the past (this post)

Part 3 - Recording rent payments

Part 4 - Recording mortgage interest

Part 5 - Recording other expenses

Part 6 - Generate and check your tax figures

What you'll get

Completing this article will mean you've got all your property details entered (covered in part 1) and recorded all the tenancies covering the tax year.

What you need

- All rental contracts that covered the financial year (started in, ended in or received any rent on during that yet)

- Any rent changes - the month it took effect and the new amount

- (optional) Deposit protection account/reference numbers

What to do

You should already have all your properties entered into PaTMa (see the previous part of this series) so now it's time to start recording the tenancies that took place during the tax year.

This means any tenancy that was running within the tax year (currently the last tax year was 6th April 2016 - 5th April 2017). Each tenancy may have started during that year, ended during that year or perhaps covered the whole year - these all need to be recorded. Let's get started.

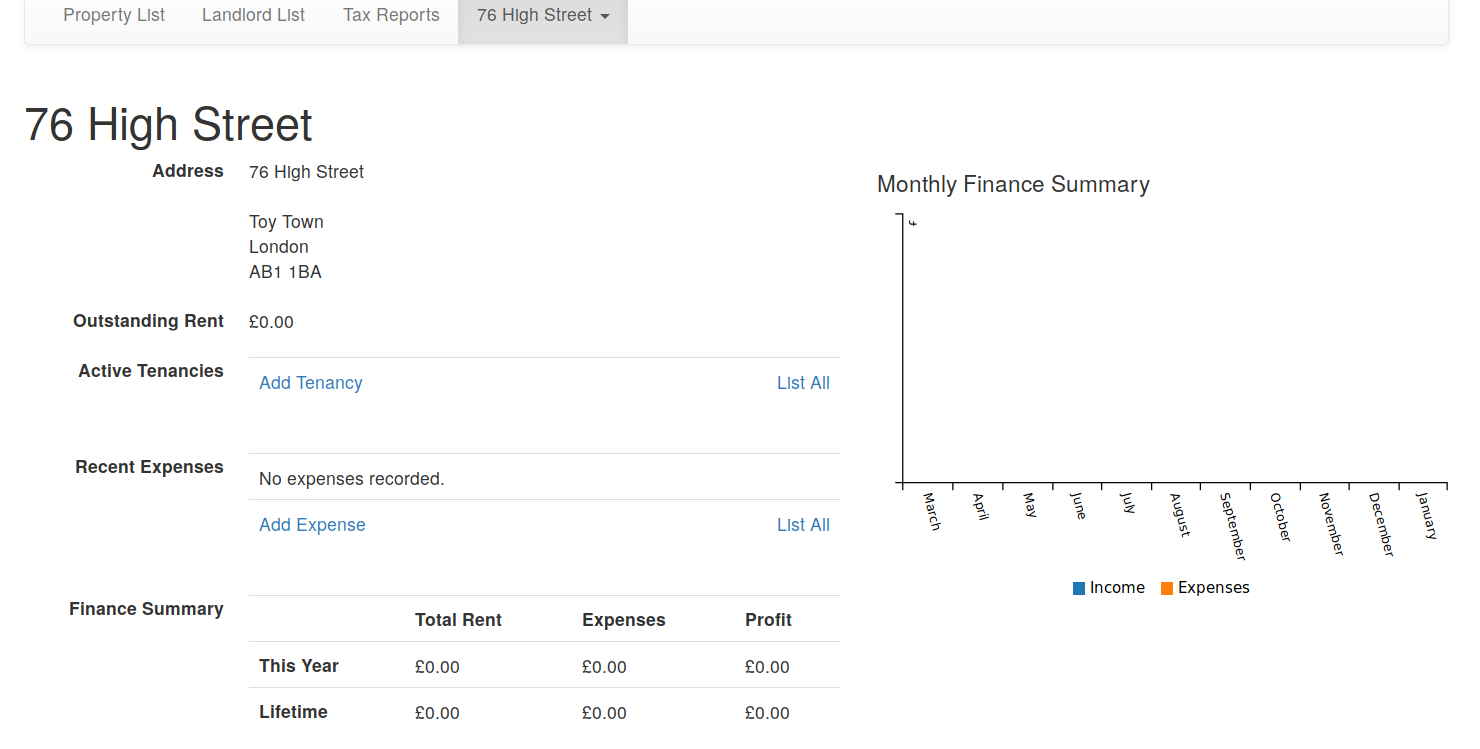

From your property list, click the first property you're going to enter tenancies for. You'll see the property details page, some like this:

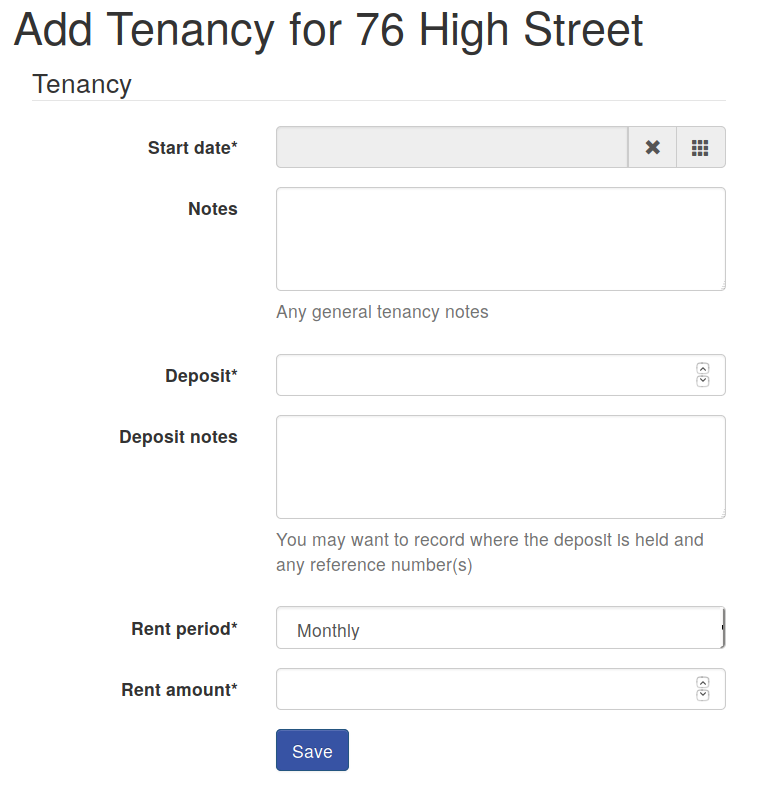

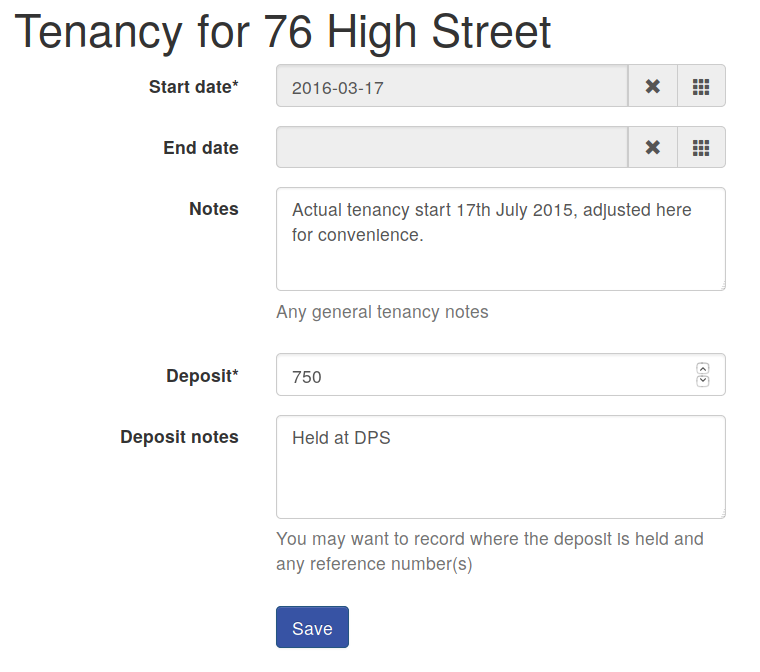

Yours is probably just as empty at the moment, but that's easily fixed, click the "Add Tenancy" link a little under the address. You'll see the following screen:

This form should be straight forward to complete, especially if you have the tenancy contract in front of you. If the tenancy you're entering is very old though, you might want to make a small adjustment to avoid needing to enter all historic rent receipts (or constantly be told there's rent outstanding).

For a very old tenancy that started before the relevant tax year I recommend that you enter a Start date of the last rent day (that the tenant was up to date) before the tax year started (5th April). So if your contract started on 17th July 2015 you'd enter a start date of 17th March 2016 instead.

Doing this means that you only need to enter a single historic rent receipt for PaTMa to think that the tenancy is all current and correct, while also keeping the figures correct for your tax return.

As mentioned above, if your tenant was behind with their rent at the start of the tax year, or the rent day previous to it, you'll need to go back further to make the figures work out properly. In this case use the last rent day (before the tax year) that they were fully up to date.

If you've entered an adjusted start date for an old tenancy, it's probably a good idea to also add a note to that effect along with the actual contract start date - just so you've got it handy when viewing the tenancy later.

Rent Changes

Any long running tenancy is likely to have rent increases during it. These also need to be recorded so that PaTMa knows to expect the higher rent.

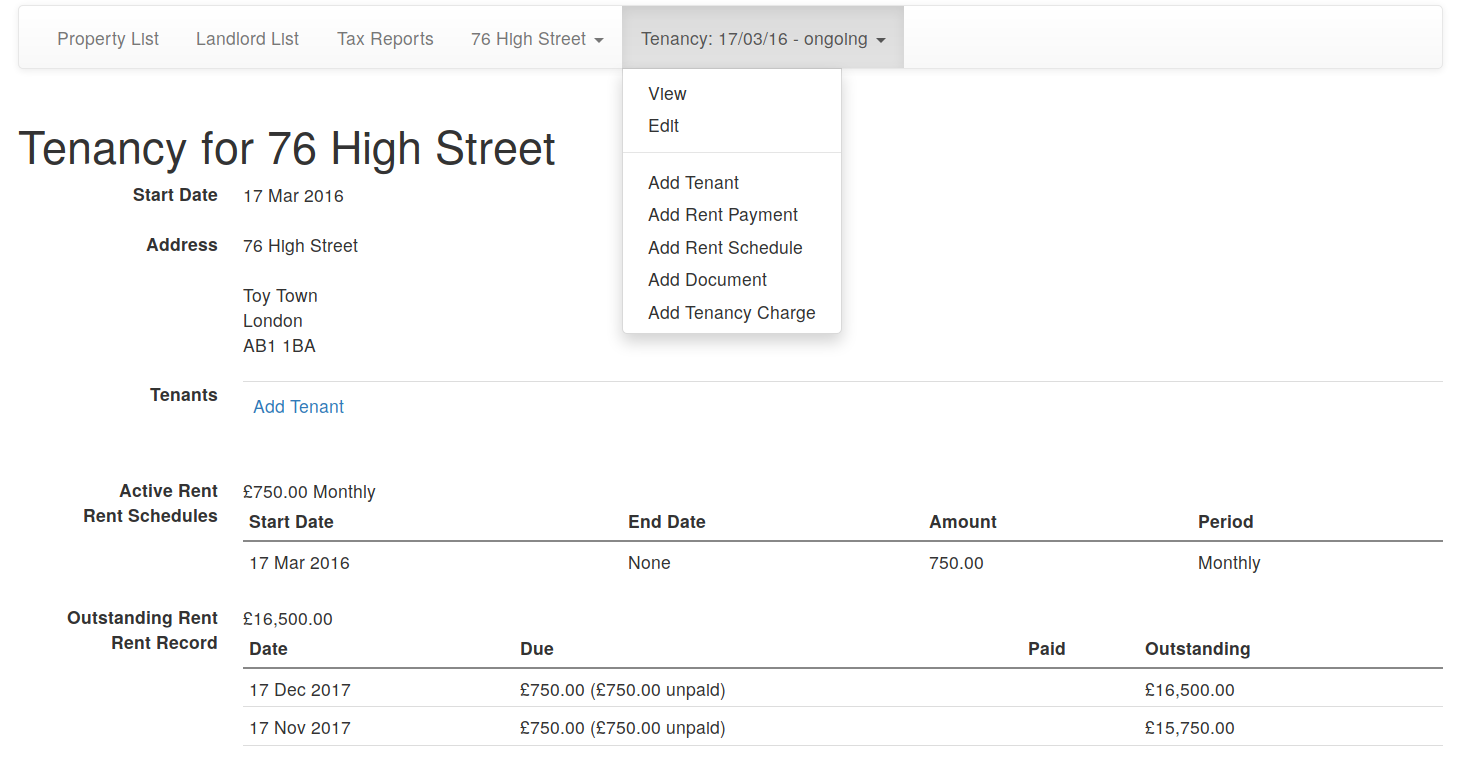

From the property detail screen click the "View" link next to the relevant tenancy.

While viewing the tenancy use the menu to select "Add Rent Schedule" as shown in the screenshot here:

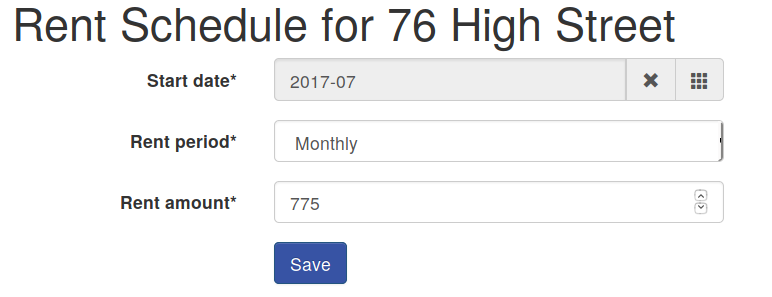

You can then select the relevant month the change occurred (the rent day within that month will be used) and enter the new rent, for example as shown:

Click Save to be returned to the tenancy view and see the adjusted (outstanding) rent record.

Tenancy Ends

The other main thing that tenancies have a habit of eventually doing is coming to and end. These obviously need to be recorded as well.

Use the tenancy menu (the same one shown above) and select "Edit" to be presented with a screen like this:

Enter the end date and click Save to update the tenancy.

Back on the tenancy detail page you'll see that the rent record has been updated - ended at the appropriate point and possibly adjusting the final rent due if it was for a partial month.

Bonuses

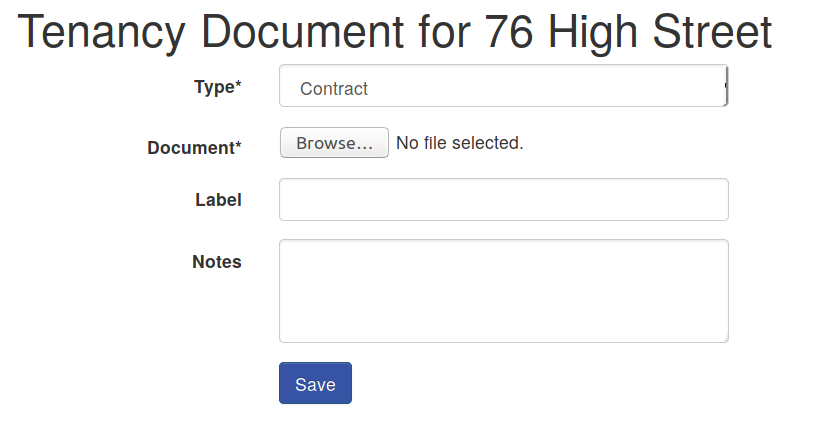

While you're here and have your tenancy contract to hand, why not upload it to the tenancy record in PaTMa for safe keeping and easy reference in future?

On the tenancy detail page, scroll down to the "Documents" section at the bottom and click "Add Document", you'll see this:

Select your contract document (you might need to scan it first to make it available on your computer), optionally enter a label and click Save.

You can also store the names of your tenants and their contact details, so they're always available when you need them. Back at the tenancy screen, use the "Add Tenant" button in the Tenants section near the top. Enter the details you have and click Save.

Next time you need to check the contract or give your tenant a call, just login to PaTMa, click the property and view the tenancy for quick and easy access.

What next

Now you have all the tenancy details stored you can start entering your rent receipts.