The PaTMa buy-to-let profit calculator will instantly turn 10 numbers into a straight forward guide to how much your next buy-to-let could make. And six of those numbers have sensible defaults and another one is optional. So really you only need 3 numbers to get started!

This post is going to walk through each of the numbers you can feed into the calculator and explain exactly what they mean.

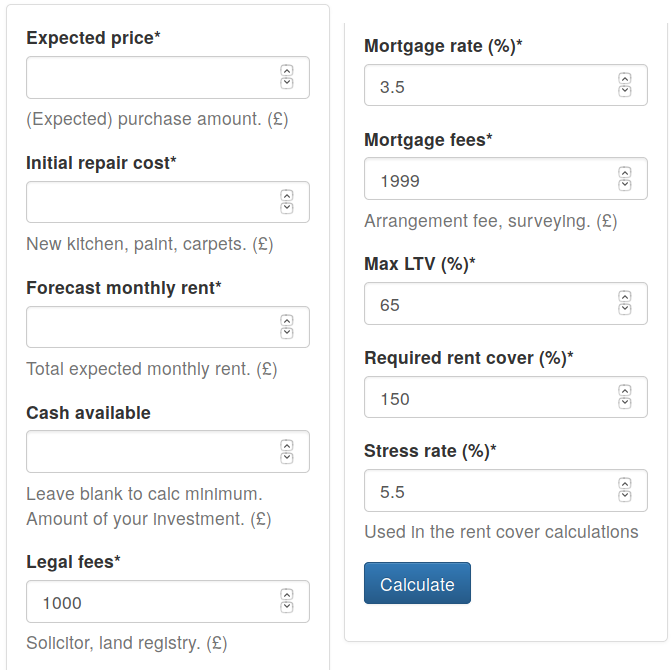

When you first view the buy-to-let profit calculator the fields you can complete are shown down the left hand side. For easier viewing, the image here is split into two columns. Other than that it shows how they first appear, complete with default values.

Expected price

This is the price you expect (or want) to be paying for the property. Enter the full amount just as number (no pound signs).

Initial repair cost

How much do you expect to pay to get the property ready to rent? There are lots of things this might include from just a good clean and some paint to moving walls, a new kitchen, bathrooms and carpet. Remember to include costs that may occur while work is being done, eg council tax, utilities and any finance costs.

Forecast monthly rent

How much will you be able to rent the property for? This should be the monthly amount you'll be receiving.

Soon you'll be able to tune the expenses applied to this to include utility bills and other costs that suitable for HMOs and other letting situations. For now though, you can still use the profit calculator by entering the amount you expect to have left after utilities and tax.

Cash available

How much cash do you want to invest? This will need to cover the deposit, repairs and stamp duty.

You can leave this blank and the calculator will tell you the minimum amount of cash you need to buy the property. Alternatively, enter a value and the calculator will tell you if you can't afford it or reduce your mortgage and show how that affects your profit.

Legal fees

Enter the amount you expect to spend on your solicitor, search and transaction fees.

We currently provide a default of £1,000 which we hope is an OK guess for an average transaction.

Mortgage rate (%)

What interest rate will you be paying for your mortgage?

Our currently default value is 3.5% which might be about right for a limited company mortgage or a higher risk personal mortgage (at the moment). Lower risk (lower LTV) personal mortgages might have fixed rates of around 2% at the moment.

Mortgage fees

How much will your mortgage cost to get setup? This might include a survey fee, broker fee and a general setup fee.

We currently default this to £1,999 which is probably a bit on the high side, but better that than estimating too low. Check with your mortgage supplier for the correct value.

Max LTV (%)

This and the next two are all about the restrictions the lender is placing on the mortgage you expect to get.

The "maximum loan to value" is a standard mortgage restriction and for buy-to-let mortgages today it might be as low as 65% or perhaps as high as 85%. You'll need to check with your mortgage broker to know what's available to you.

Required rent cover (%)

"Rent cover" or "rental cover" are a relatively new restriction that's being placed on buy-to-let mortgages. This value is the percentage of the mortgage (at stress rate, see below) that the rent must be.

A fairly standard value for this is 150% but it varies between lenders and based on your own situation.

Stress rate (%)

The interest rate used to calculate mortgage payments for the rent cover calculation (see above).

Again these vary between lenders and with your personal circumstances, we default to 5.5% as a fairly safe starting point. Adjust this based on talking to your mortgage broker.

Calculate

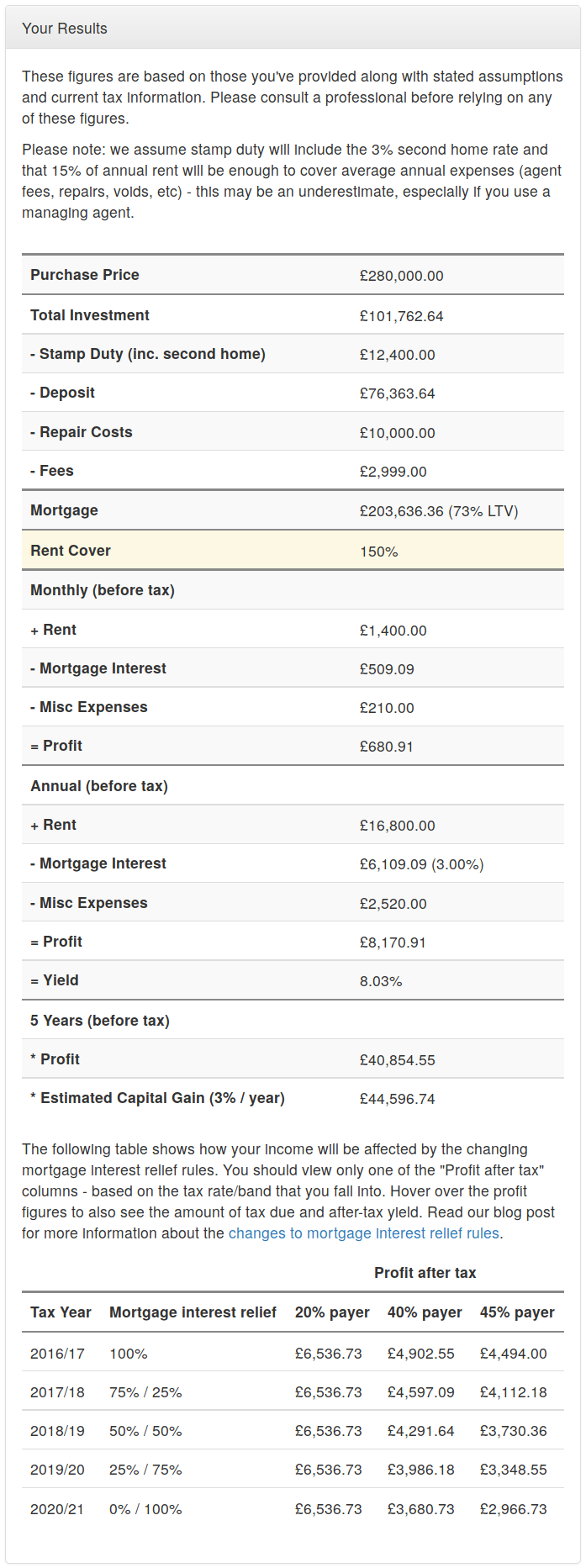

With all the details above filled in for your scenario, hit the Calculate button to see your results, they'll look something like this:

Try for free

Our buy-to-let profit calculator is completely free so why not give it a go now, click here.